I Can’t Afford My Loved One’s Funeral

I Can’t Afford My Loved One’s Funeral

Losing a parent or a partner is heartbreaking. And in the midst of grief, struggling to work out how you can afford a funeral is something you can do without.

With the average cremation costing £3,858 and a burial around £5,000, it isn’t the sort of money you are going to be able to find down the back of the sofa. A lot of people are now starting to take out pre-payment plans, which can help alleviate the strain.

If this hasn’t been the case, there are a number of options available to you.

But before you start sourcing the money, think carefully about how much you realistically need to spend. We all want to give our loved one’s the best send-off possible, but they wouldn’t want you going in to debt because you bought extra flowers or paid for a second car.

Go through the elements of the funeral and work out where you could make savings. And once those decisions have been made, consider your course of action for finding the money. These include:

• Your loved one’s estate: It depends what assets have been left, but if there are sufficient, the funeral expenses can be claimed during probate.

• Funeral Expenses Payment: This is a Government scheme for those on benefits. Whether you qualify for the support depends on your relationship with the deceased and what benefits you are receiving.

• Budgeting Loan: Nobody wants to get into debt, but if you are in receipt of Pension Credits, Income Support, Income-based Jobseeker’s Allowance or Income-related Employment and Support Allowance, you could be eligible for an interest-free loan that will be paid back from your benefits.

• Veterans UK: This charity will help towards the cost of a small funeral, if your loved one died while serving in the Forces.

• Council funeral: Previously called a pauper’s funeral, there will be no flowers or cars and, although you will be able to attend, the local authority will choose where and when it will take place.

• Paying in instalments: It is possible that the undertaker will allow you to pay over a period of time. There will be an initial upfront payment, but it will relieve some of the immediate stress.

• Deceased’s bank account: If there are sufficient funds available, this will be quicker than waiting for probate. Speak to the bank and if they are willing, on receipt of the invoice, they will make the payment.

• Friends and family: Don’t take on the full burden if there are family members or friends of the deceased who would be willing to help.

• Charities: There are some organisations who are willing to offer grants to help with funeral costs. If you are struggling, this is worth considering.

If you wish to discuss a pre-paid funeral plan with us, get in touch.

Back To BlogShare This Post

Recent posts

- When Do You Need Probate & When Is It Required? By The Probate Bureau , 26/07/2023

- Losing a Loved One at Christmas By Probate Bureau , 16/12/2020

- Probate - Your Questions Answered By Probate Bureau , 01/09/2020

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 1 posts

2023 Archive

- July 8 posts

Blog Categories

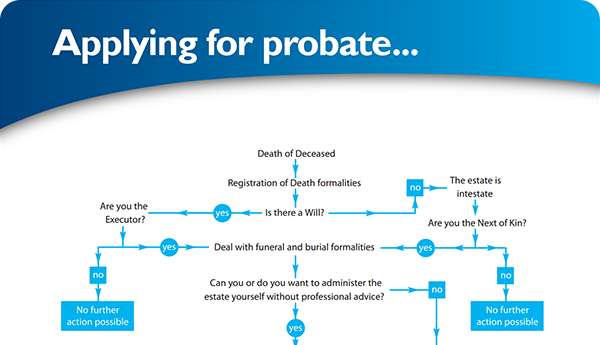

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×