Protecting Your Assets

Protecting Your Assets

Most people who co-own their home with another person do so as Joint Owners. They both own the whole property. On the death of a Joint Owner, the home AUTOMATICALLY becomes the sole property of the survivor - who can then do what they want with it. However this can cause problems:

If the survivor then remarries, it is possible that the whole of the house will then pass to their new spouse on their death, thus disinheriting the children of the first marriage. OR If the survivor has to go into a Nursing or Residential Home, as the sole owner of the property, the Local Authority has powers to charge the cost of care against the value of the whole house, again disinheriting the children.

The answer to all of these problems, is to change the way the home is owned from Joint Owners to Tenants in Common - a straightforward process that doesn't involve the mortgage company even if the property is mortgaged. As Tenants in Common each owner owns one half of the property and, using a Will, can do whatever they wish with their share of the property on their death, including:

1. leaving it to their (own) children so that is the surviving spouse remarries they will only own their own half of the property and can only give their own share to their new spouse.

2. leaving it to their (own) children so that if a surviving spouse needs care, the Local Authority can only charge the cost of care against the half of the house that they own - ensuring in either case that their children inherit at least half of the value of their home. In fact recent case law indicates that the value of half a house (providing the owners of the other half don't want to sell their share) is effectively Nil and in these circumstances the Local Authority may not be able to charge any of the cost of care against the value of the house.

We do, however, recommend that in the above situations provisions are also made in the Will, sometimes through a Will trust, to delay the gift and prevent the surviving spouse being forced out of the home and also to ensure that the surviving spouse can have access to the capital and/or income if the house is sold. This type of trust is called a Life Interest Trust and is sometimes marketed as a Property Protection Trust.

Protecting your savings etc

The trusts referred to above can also be used to protect savings etc from loss in the event of re marriage or the need to fund care fees. This type of trust is also a Life Interest Trust but is sometimes marketed as a Flexible Life Interest Trust.

If you would like one of our consultants to advise you on gaining the benefits of including a life interest trust in your Wills just call 0800 028 2837 FREE.

Please note that these arrangements only apply to couples who are drafting Wills. They are not effective for single people. It is therefore essential to plan early.

2015 Update: Care in respect of Will Trusts now needs further consideration in light of the phasing in of the new Residence Nil Rate Bate ("RNRB")

Share This Post

Recent posts

- What Happens If You Die Without a Will in England and Wales By Admin , 04/03/2026

- Power of Attorney vs Deputyship: Which Do You Need? By Admin , 04/03/2026

- Probate Delays and How to Speed Things Up in 2026 By Admin , 03/02/2026

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 2 posts

2023 Archive

- July 10 posts

Blog Categories

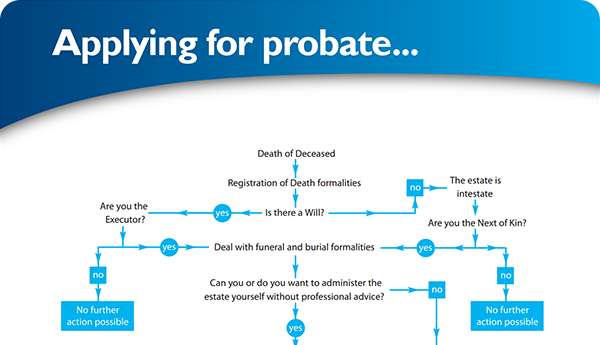

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×