Estate Administration Hertfordshire – Expert Guidance Through Every Step

Estate Administration Hertfordshire – Expert Guidance Through Every Step

Administering the estate of a loved one is one of the most complex legal and financial processes most people will ever face. When that estate includes property, savings, investments and personal effects spread across Hertfordshire, the challenge can quickly feel overwhelming. Executors and family members often find themselves balancing legal obligations, tax responsibilities and emotional pressures at a difficult time.

At The Probate Bureau, we have supported families across Hertfordshire for decades, guiding them through estate administration with empathy, transparency and efficiency. This detailed guide explains how estate administration works, what your responsibilities are as an executor, and how local expertise can simplify what might otherwise be a stressful process.

Understanding Estate Administration

Estate administration is the process of managing a person's assets, debts and final wishes after their death. It involves identifying and valuing assets, paying outstanding debts, handling tax matters, and ensuring the remainder is distributed according to the Will or, if there is none, under intestacy rules.

Although it sounds straightforward, the process is legally binding and full of detail. Executors must deal with banks, investment providers, insurers, HMRC and the Probate Registry, often while coordinating property sales or complex financial matters. In Hertfordshire, where property values are higher than the national average and estates can include business assets or second homes, having professional support ensures compliance and peace of mind.

The Role of the Executor or Administrator

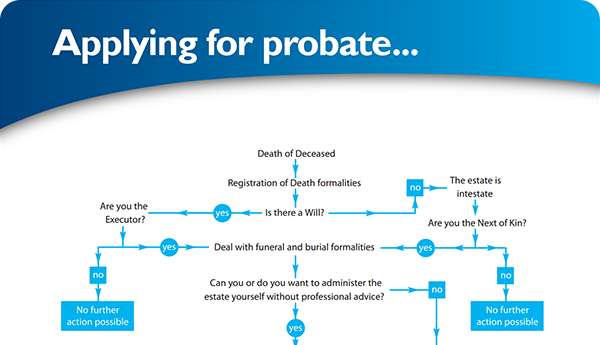

If the deceased left a valid Will, the named executors are responsible for carrying out their wishes. If no Will exists, a close relative or next of kin usually applies to become the administrator. Both roles involve the same practical tasks and legal duties.

Executors must collect and protect the estate's assets, ensure debts and taxes are paid, and then distribute what remains to the beneficiaries. They must keep detailed records and act in the best interests of everyone involved. Mistakes can have serious consequences, so many people in Hertfordshire choose to appoint The Probate Bureau to handle administration on their behalf. This not only saves time but also reduces personal risk.

First Steps After a Death

After registering the death and obtaining copies of the death certificate, the executor's first task is to locate the Will. Once the Will has been confirmed, the next step is to identify all assets and liabilities. This means writing to banks, pension providers, mortgage companies and other financial institutions to obtain balances as of the date of death.

It is important to keep everything organised. Even a modest estate can involve dozens of accounts and documents. The Probate Bureau's Hertfordshire team often begins by creating a full schedule of assets and debts so that executors have a clear picture of the estate's position from the start.

Valuing the Estate

Accurate valuation is critical, particularly for Inheritance Tax purposes. Property should be appraised by a qualified valuer who understands the local Hertfordshire market. Vehicles, jewellery and personal effects may also require professional valuation.

For financial assets, institutions will confirm balances in writing. Shares and investments should be valued using closing prices on the date of death. All of this information forms part of the Inheritance Tax return submitted to HMRC, even if the estate ultimately falls below the taxable threshold.

Applying for the Grant of Probate

Once valuations are complete and any tax forms have been submitted, the next step is to apply for a Grant of Probate (if there is a Will) or a Grant of Letters of Administration (if there is not). This legal document gives the executor authority to access bank accounts, sell property and manage the estate.

In Hertfordshire, applications are usually made online or by post to the Probate Registry. The process can take several weeks depending on the Registry's workload. The Probate Bureau handles this stage for clients, ensuring forms are correctly completed and supporting documents are submitted to avoid delays.

Settling Debts and Paying Taxes

After the Grant is issued, the executor can begin collecting the estate's assets. Funds can be transferred into an executor's account, property can be sold, and investments can be liquidated. At this stage, debts must be repaid, including mortgages, loans, credit cards and utility bills.

Inheritance Tax is payable before the Grant is issued if the estate exceeds the tax-free threshold, but income tax or capital gains tax may also arise later in the process. We liaise directly with HMRC to ensure all tax matters are resolved correctly.

Distributing the Estate

Once debts and taxes are cleared, the remaining assets can be distributed in accordance with the Will. This often involves transferring funds, selling property, or distributing personal items to beneficiaries. Executors should always prepare clear accounts showing exactly what was received and paid out. These records protect the executor and provide transparency for beneficiaries.

At The Probate Bureau, we prepare detailed estate accounts for every client, ensuring the process concludes smoothly and without dispute.

The Hertfordshire Advantage

Working with a Hertfordshire-based specialist has practical benefits. Our local knowledge of estate agents, property valuers, conveyancers and banks helps us move matters forward efficiently. We also understand the region's housing market, which is often central to estate value.

Because we are local, clients can visit our offices in person, sign documents easily, and discuss matters face-to-face with a case manager who understands both the legal process and the personal circumstances surrounding it.

How Long Does Estate Administration Take?

For a straightforward Hertfordshire estate with no property sale or inheritance tax, administration can often be completed within six months. More complex estates involving multiple assets, property sales or tax issues can take between nine and twelve months, while estates in dispute may extend beyond a year.

We always provide clear timelines at the start of each case so clients know what to expect.

Fixed Fees and Transparent Costs

The Probate Bureau pioneered fixed-fee estate administration in Hertfordshire. Our fees are agreed upfront so you can budget confidently with no hourly rates or surprise costs. This transparent approach has made us one of the most trusted probate specialists in the region.

Compassion and Clarity Throughout

Administering an estate is never just about paperwork. Families are often coping with grief while trying to make important financial decisions. Our role is to take the administrative burden off your shoulders so you can focus on what truly matters. Every client is assigned a dedicated case manager who keeps them informed and supported from start to finish.

Internal Links

Conclusion

Estate administration in Hertfordshire can seem daunting, but with the right guidance it does not have to be. Whether you are an executor managing a loved one's estate or a beneficiary seeking clarity on the process, The Probate Bureau is here to help. With fixed fees, local expertise and compassionate service, we make sure every step of the process is handled efficiently, transparently and with care.

To speak to our Hertfordshire team about estate administration, visit our Contact Us page today.

Back To BlogShare This Post

Recent posts

- What Happens If You Die Without a Will in England and Wales By Admin , 04/03/2026

- Power of Attorney vs Deputyship: Which Do You Need? By Admin , 04/03/2026

- Probate Delays and How to Speed Things Up in 2026 By Admin , 03/02/2026

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 2 posts

2023 Archive

- July 10 posts

Blog Categories

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×