Gifting Assets – How Lifetime Giving Can Lower Your Inheritance Tax Bill

Gifting Assets – How Lifetime Giving Can Lower Your Inheritance Tax Bill

Introduction

Gifting assets is one of the most effective ways to reduce inheritance tax in the UK. It allows you to transfer wealth to your loved ones during your lifetime, helping them when they need it most while gradually reducing the size of your taxable estate.

However, inheritance tax law around gifting is often misunderstood. Some gifts are exempt immediately, while others may still be taxable if you die within seven years. Understanding these rules, recording gifts accurately, and planning strategically are key to ensuring your generosity benefits your family rather than HMRC.

This comprehensive guide from The Probate Bureau explains how lifetime giving works, what gifts qualify as tax-free, and how to make sure every decision you take forms part of a compliant, long-term inheritance tax mitigation plan.

1. What Is a Lifetime Gift?

A lifetime gift is any transfer of value made while you are still alive, whether it involves money, property, or other assets. Common examples include:

- Cash gifts to family members or friends

- Property transfers, such as gifting a share of your home

- Investments, such as shares, bonds or business interests

- Valuable possessions, such as jewellery, antiques, or cars

When structured correctly, these gifts can fall outside your taxable estate. However, each type of gift has different tax implications, so understanding the rules is essential.

2. The Seven-Year Rule Explained

The seven-year rule is central to inheritance tax planning through gifting. Most significant gifts are classified as Potentially Exempt Transfers (PETs). This means that no inheritance tax is due if you survive for seven years after making the gift.

If you die within seven years, the value of the gift may still count towards your estate, potentially creating a tax liability. However, the amount of tax payable reduces over time thanks to taper relief.

Taper Relief for Gifts

| Years Between Gift and Death | % of Inheritance Tax Payable |

|---|---|

| 0–3 years | 100% |

| 3–4 years | 80% |

| 4–5 years | 60% |

| 5–6 years | 40% |

| 6–7 years | 20% |

| 7+ years | 0% |

Taper relief applies only when the total value of gifts exceeds the nil-rate band (£325,000). It reduces the tax rate, not the value of the gift.

Why Record Keeping Matters

Maintaining detailed records of all gifts, including dates, values, and recipients, is essential. Your executors will need this information to calculate inheritance tax accurately. Keeping a simple “Gift Log” can prevent disputes and speed up the probate process later.

3. Annual Gifting Exemptions and Small Gift Allowances

Every individual in the UK has an annual gifting allowance of £3,000 per tax year, which is completely exempt from inheritance tax. If you did not use your allowance last year, you can carry it forward for one additional year, allowing a potential tax-free gift of £6,000. For couples, this doubles to £12,000 per year.

You can also make small gifts of up to £250 per person each tax year, provided they are not recipients of your £3,000 exemption.

Example

A grandmother gives each of her four grandchildren £250 for birthdays and Christmas, and a further £3,000 to her daughter. None of these gifts will count towards her taxable estate.

These small, regular acts of generosity can significantly reduce inheritance tax over time, especially when part of a broader plan.

4. Wedding and Civil Partnership Gifts

Certain gifts made in connection with a marriage or civil partnership are exempt from inheritance tax. These can be a thoughtful and tax-efficient way to support loved ones starting a new chapter.

You can give:

- Up to £5,000 to your child

- Up to £2,500 to a grandchild or great-grandchild

- Up to £1,000 to anyone else

The only condition is that the gift must be made before the ceremony, and the marriage or civil partnership must actually take place.

5. Gifts Made from Surplus Income

One of the most valuable but least understood inheritance tax exemptions applies to regular gifts made from surplus income. If your income (from pensions, employment, dividends or investments) consistently exceeds your living costs, you can make regular gifts from that surplus that are immediately exempt from inheritance tax.

Conditions to Qualify

- The gifts must form a pattern of regular giving (for example, monthly payments or annual school fees).

- They must come from income, not capital.

- The gifts must not reduce your normal standard of living.

Example

A retired couple receive a joint pension of £70,000 per year but only spend £50,000. They can gift £20,000 annually to their children or grandchildren without any inheritance tax implications, provided they keep clear records showing the payments come from income.

These gifts are immediately outside the estate and do not rely on the seven-year rule.

6. Charitable Gifts During Your Lifetime

Donations to UK-registered charities are 100% exempt from inheritance tax, whether made during your lifetime or through your will.

Lifetime charitable giving has additional benefits. It can reduce taxable income in some cases, lower the overall value of your estate for inheritance tax calculations, and allow you to witness the positive impact of your donation.

Additionally, leaving 10% or more of your net estate to charity through your will can reduce the inheritance tax rate on the remaining estate from 40% to 36%. Philanthropy can therefore be both rewarding and financially sensible.

7. Gifting Property or Shares

You can gift property or shares as part of your estate planning, but these transactions may trigger Capital Gains Tax (CGT) if the asset has increased in value since purchase.

Key Considerations

- Gifts between spouses or civil partners are exempt from CGT.

- Hold-Over Relief may apply to certain business or agricultural assets, deferring CGT until the recipient sells the asset.

- You can gift a share of your home, but if you continue to live there rent-free, it may be classed as a “gift with reservation” and still count towards your estate.

Gifting property requires professional advice to balance the inheritance tax savings with potential capital gains implications.

8. Using Trusts for Controlled Gifting

Trusts allow you to transfer assets out of your estate while retaining some control over how they are used. They are particularly useful for protecting wealth for younger beneficiaries or managing complex family arrangements.

Common Types of Trusts

- Bare Trust: The simplest form of trust. Beneficiaries have immediate rights to the assets, but they remain under the care of trustees until a specified age.

- Discretionary Trust: Trustees decide how and when to distribute assets, giving flexibility for changing circumstances.

- Interest in Possession Trust: The beneficiary has the right to income from the trust but not ownership of the capital.

Trusts can be effective tools for inheritance tax mitigation, though they are subject to specific reporting and taxation rules under HMRC. At The Probate Bureau, we work with trusted legal partners to ensure that any trust is correctly established and fully compliant.

9. Combining Gifting with Other Inheritance Tax Strategies

Lifetime gifting is even more powerful when integrated with a full inheritance tax plan. You can combine gifting with other strategies, such as using the Residence Nil-Rate Band to protect the family home, writing life insurance policies in trust so payouts are not taxed, and creating a charitable legacy to reduce the effective tax rate.

A well-planned approach ensures that every available relief, exemption, and allowance is used efficiently. This reduces the total inheritance tax burden while maintaining flexibility for future financial changes.

10. When Should You Start Gifting?

The earlier you start gifting, the greater the benefits. Small, consistent transfers over time compound into significant estate value reductions.

Even if you are not ready to make large gifts, starting with annual exemptions, birthday presents, or regular income-based gifts can make a noticeable difference.

Top Tips for Successful Gifting

- Document everything. Keep written records of gifts, dates, and reasons.

- Review annually. Tax laws evolve, so check your plan each year.

- Seek advice. Professional inheritance tax specialists can ensure your strategy remains compliant and effective.

Remember, gifting should fit within your overall estate plan, not compromise your own financial security.

11. Common Mistakes to Avoid

While gifting can save significant tax, errors can lead to unexpected liabilities. Common pitfalls include giving away assets but continuing to benefit from them (for example, living in a gifted property rent-free), failing to record gifts properly for HMRC evidence, gifting too much too soon and leaving insufficient funds for personal care or living costs, and overlooking the impact of capital gains tax on certain assets.

A balanced and documented strategy will protect both your estate and your peace of mind.

12. How The Probate Bureau Can Help

At The Probate Bureau, we have helped thousands of families across Hertfordshire and the surrounding regions plan for the future. Our inheritance tax specialists provide clear, jargon-free advice to ensure your lifetime gifting strategy aligns with your goals.

We offer:

- Fixed-fee consultations for inheritance tax and estate planning.

- Tailored gifting plans based on your assets, age, and family structure.

- Trust creation and management support with our legal partners.

- Collaboration with accountants and financial advisers to ensure tax efficiency.

Our priority is to help you keep control of your estate while reducing your family’s tax exposure legally and responsibly.

13. Real-Life Example: The Power of Early Planning

Consider John and Margaret, a retired couple from Hertfordshire. Their combined estate, including property and investments, was valued at £1.4 million, well above the inheritance tax threshold.

With professional help, they gifted £6,000 annually to each of their three grandchildren, made regular income-based payments to help their children with school fees, and established a discretionary trust for a portion of their investments.

After seven years, more than £300,000 had been legally removed from their taxable estate, saving the family around £120,000 in inheritance tax while allowing John and Margaret to enjoy seeing their family benefit.

14. The Importance of Professional Advice

Inheritance tax planning is complex, and one-size-fits-all solutions rarely work. Professional advice ensures that your approach remains compliant, up to date, and tailored to your financial circumstances.

By partnering with The Probate Bureau, you receive guidance built on decades of experience in estate planning, probate, and inheritance tax mitigation.

Conclusion

Gifting assets is one of the most practical and rewarding ways to reduce inheritance tax in the UK. By understanding the rules, documenting your actions, and combining multiple tax reliefs, you can ensure that more of your hard-earned wealth passes to those who matter most.

Start early, review regularly, and seek expert advice to make your lifetime giving strategy as effective as possible Call us today!.

Back To BlogShare This Post

Recent posts

- What Happens If You Die Without a Will in England and Wales By Admin , 04/03/2026

- Power of Attorney vs Deputyship: Which Do You Need? By Admin , 04/03/2026

- Probate Delays and How to Speed Things Up in 2026 By Admin , 03/02/2026

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 2 posts

2023 Archive

- July 10 posts

Blog Categories

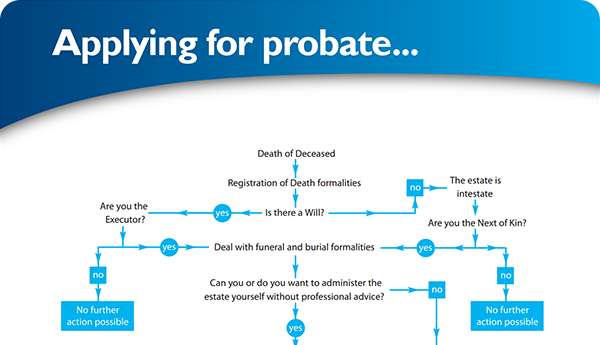

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×