Probate Costs Set To Rise

Probate Costs Set To Rise

The UK government is planning a huge hike in probate fees in a bid to raise a further £250m a year. The flat fee of £215 is set to be replaced with a new tiered system of charges. Some could end up paying as much as £20,000 on estates in excess of £2m.

Estates worth between £500,000 and £1m the new fee will be £4,000, rising to £8,000 for those worth between £1m and £1.6m, and £12,000 for those valued at between £1.6m and £2m!

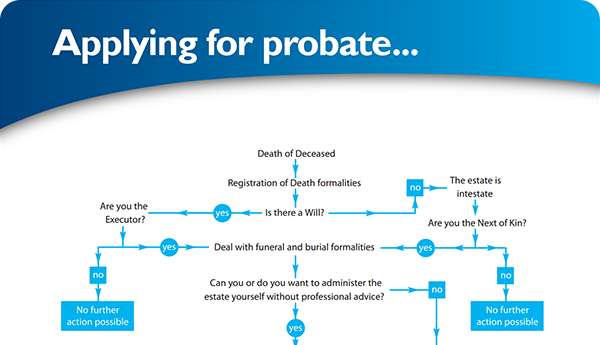

The rise in property prices, especially in the South East, in recent years means that more and more bereaved families are likely to be hit with this additional tax. Getting a Grant of Probate (or Letters of Administration if there is no Will) is a legal process whereby the Executor/s or Personal Representatives of a deceased person's estate gain the authority to cash in assets and sell property in order to distributed that estate.

Not all estates need to go through the 'probate' process. The Ministry of Justice has said that these measures would mean that smaller estates (up to £50,000) would end up paying no fees at all, great news. However 27% of estates would see a “modest” increase of £85 to £300. Estates valued between £500,000 & £1,000,000 would pay £4,000, £8000 for those up to £1,600,000, £12,000 for those up to £2,000,00 and a whopping £20,000 for estates in excess of £2,000,000!

Now is a good time to plan. The Probate Bureau can and will help you save time, money and no small amount of stress at an already taxing time in your life.

Share This Post

Recent posts

- Probate Delays and How to Speed Things Up in 2026 By Admin , 03/02/2026

- Inheritance Tax Planning: 2026 Allowances and Exemptions Guide By Admin , 03/02/2026

- Making a Will at Christmas: Why the Holidays Are the Right Time By Admin , 23/12/2025

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 2 posts

2023 Archive

- July 10 posts

2026 Archive

- February 13 posts

Blog Categories

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×