How A Little Planning Can Save You Thousands

How A Little Planning Can Save You Thousands

How the new Residence Nil-Rate Band and the proposed Grant of Probate fees will affect your beneficiary’s inheritance

Main Residence Nil-Rate Band ('MRNRB')

The new Residence Nil-Rate Band was introduced by the Government as a “fairer” method of applying Inheritance Tax: If you are married or in a civil partnership, you can enjoy an additional £350,000 (by 2020/2021) of tax free estate between you. Sounds great, especially if you live in a more affluent area with house prices above the national average, but is it fairer when you don’t get this additional tax relief if you are single or if it is withdrawn (by £1 for every £2) if your estate is over £2,000,000? I am really looking forward to seeing the new tax forms on that one!

The draft Finance Bill 2016 clause and Explanatory notes were published on 9 December 2015.

This measure introduces an additional nil-rate band when a residence is passed on death to a direct descendant. This will be:

• £100,000 in 2017 to 2018

• £125,000 in 2018 to 2019

• £150,000 in 2019 to 2020

• £175,000 in 2020 to 2021

This is going to make administering an estate a lot more complex so it is strongly advised that you contact a competent probate professional like The Probate Bureau before you start winding up an estate. You can get more information on the Government’s website

Grant of Probate Fees

Currently, if an estate is less than £5,000, no fee is charged for obtaining a Grant of Probate. There is a flat fee of £155 for estates above the value of £5,000 if The Probate Bureau or a solicitor obtains the grant on your behalf. If, however, the Grant is sought by an individual, the fee is £215.

The proposals put forward aim to increase the fees significantly. Where an estate is above £500,000 but below £1,000,000, the fee is set to increase to £4,000. For estates over £2,000,000 fees will increase by over 9000% to a whopping £20,000!

| Estate value (prior to IHT) | Current Fee | Proposed Fee | |||||

| Up to £50k or exempt | £155 or £215 | £0 | |||||

| Over £50k but does not exceed £300k | £155 or £215 | £300 | |||||

| Over £300k but not exceed £500k | £155 or £215 | £1,000 | |||||

| Over £500k but does not exceed £1m | £155 or £215 | £4,000 | |||||

| Over £1m but does not exceed £1.6m | £155 or £215 | £8,000 | |||||

| Over £1.6m but does not exceed £2m | £155 or £215 | £12,000 | |||||

| Over £2m | £155 or £215 | £20,000 |

|

Share This Post

Recent posts

- Probate Delays and How to Speed Things Up in 2026 By Admin , 03/02/2026

- Inheritance Tax Planning: 2026 Allowances and Exemptions Guide By Admin , 03/02/2026

- Making a Will at Christmas: Why the Holidays Are the Right Time By Admin , 23/12/2025

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 2 posts

2023 Archive

- July 10 posts

2026 Archive

- February 13 posts

Blog Categories

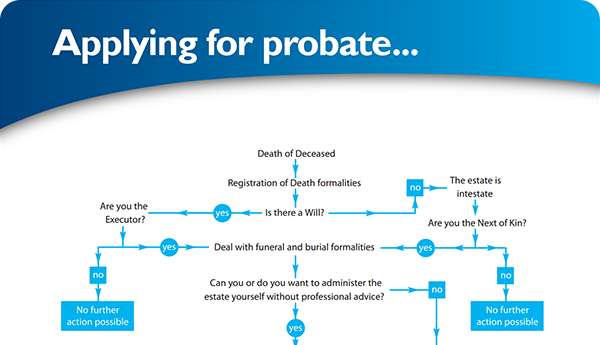

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×