Probate Services Hertford

Probate Services Hertford

Probate Services Hertford Explained by The Probate Bureau

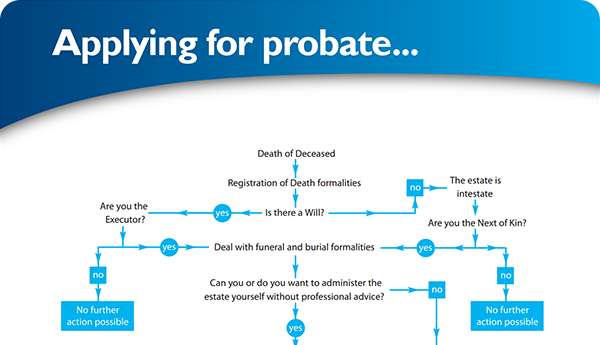

Probate Services What is Probate? Probate is the administration process which resolves claims and distributes a deceased person's estate. The granting of probate is the first step in this legal process.

What is a Will? A will is a legal document by which someone expresses their wishes of how their property and assets, known as the estate, will be distributed when they die. At least one executor must be appointed in a will, and they are responsible for managing the estate to its conclusion.

How does Probate work without a Will? Probate is the legal process that takes place to take care of the assets and liabilities when a person passes away. The process is done through the probate court. If a person dies and leaves a will, then probate is required to implement the provisions of that will. The probate process still needs to happen if a person dies without a will and has property and assets that need to be distributed under the law of inheritance.

Can I do Probate Myself? You can do probate yourself, it takes a lot of time, on average takes between 6 to 9 months to complete and can take up to eighty working hours. Be aware that other complications can mean the process takes considerably longer. Complications could be, if the Will is contested, or the deceased did not keep a clear record of all their assets. If you are considering doing probate yourself then do your research before you start to make sure you can dedicate the time needed for this legal process.

The process consists of:

- Valuing the estate

- Collating the deceased bank accounts and insurance policies

- Completing the Probate Application Form (PA1)

- Even if the estate does not owe inheritance tax (IHT) an IHT205 Form must be completed for the HMRC

- Submitting the forms

- Attending a probate interview to swear 'on' oath what you have submitted is accurate

- Paying the tax due

What are Probate Fees? Probate Fees are the fees for the services of both the solicitor and executor and they are taken from the deceased's estate. If the executor is a family member who will inherit from the estate then it is common for them to waive their fees.

Do you have to go through Probate if there is a will? Wills only need to go through probate if you want to transfer the ownership of assets from the deceased to their living beneficiaries.

How do you go through Probate without a Will? The probate process begins when you file the probate petition with the probate court to either; admit the will to probate and appoint the executor or; if there is no will, to appoint an administrator of the estate.

What happens to your children if you don't have a Will? When you die without a will, the law takes over and the court will distribute your assets to your next of kin based on order of succession. If they are minors, the probate court will also have to appoint a conservator for them, as well as a guardian, therefore a legally written will is very important to make sure your children are looked after and cared for by the person who you want to be their guardian.

What needs to go through Probate? Not everything you own will automatically go through probate. Generally, assets that don't go through probate are; jointly owned assets that transfer to the surviving owner; assets that have a valid beneficiary designation; and assets that are in a trust. Therefore, it is not always necessary to obtain Probate if all the deceased's assets are jointly held with a surviving spouse as these assets will pass automatically. It is always best to check these with a solicitor when preparing the process and documentation as they don't always avoid probate, therefore it is always best to check first.

What do I need to do to ensure my assets and estate are distributed as I want them to when I pass away? Always visit a professional and qualified solicitor who specialises in writing wills as they can be complicated and hard to understand yourself. Talk to your solicitor about your wishes in every circumstance, covering every chain of event to ensure your wishes are followed. When they have given their advice, ask them questions about what would happen in specific situations to ensure they have understood your wishes. Be aware, if you don't have a comprehensive will that has been written and certified correctly then this can often cause issues and family rifts when you pass away.

Many estates and assets diminish in these situations as the legal costs can be huge. Always talk through your will with your family members to make sure they are clear about your wishes when you pass away.

How much is Inheritance Tax in the UK? Your estate will owe tax at 40% on anything above the £325,000 inheritance tax threshold when you die, or 36% if you leave at least 10% to a charity. The standard Inheritance Tax rate is 40%. It's only charged on the part of your estate that's above the threshold of £325,000. As an example, if your estate is worth £500,000 your tax-free threshold is £325,000. The Inheritance Tax will be charged at 40% of £175,000 (£500,000 minus £325,000).

Do you pay tax on inherited money? You don't usually pay tax on anything you inherit at the time you inherit it. You may need to pay: Income Tax on any profit you later earn from your inheritance, for example, dividends from shares or rental income from a property and Capital Gains Tax if you later sell shares or a property you inherited.

About the Probate Bureau

We are a family run business and were established in 1999 after lots of people were experiencing problems with some of the traditional providers of probate estate administration services. In conjunction with our sister company TPB Financial Services, we offer bespoke legal and financial solutions, saving families money and administering estates in sometimes half the time and at half the cost of most other providers.

Our friendly and professional team are always on hand to guide you through an ever-increasing complex area of legal practice. We are based in Hertfordshire together with our sister company, TPB Financial Services Ltd. We offer a unique blend of bespoke legal and financial solutions to families at very difficult and stressful times.

As well as offering a full probate administration service in Hertford, we also provide estate planning, inheritance tax advice and the drafting of Wills, Trusts and Lasting Powers of Attorney.

The Probate Bureau Ethos. Our ethos is to save families time, money and stress. We shoulder the whole burden of winding up an estate from paying the funeral director to getting final Inland Revenue clearance and offer the best service at a fair and reasonable fixed fee. Our highly efficient and qualified team is led by our in-house lawyer and if there are no complications we administer many estates within 6 months.

We offer a free, no obligation meeting in your home and we will answer any concerns and questions you have at this difficult time. Our consultants aren't paid commission, and we don't pay or receive any commission from other businesses. This means you are safe in the knowledge we will do the best for you and your family.

We are the longest running specialist estate administration firm in the UK and are recommended by over 1000 independent funeral directors. We are well respected and highly trusted in the industry and this means we have been able to secure professional discounts which we then pass onto our customer's, resulting in more money being retained within a family and estate.

Why Choose Us? Most our business comes from personal recommendation, here are some of the reasons why you should choose us to help you with your Probate or Will:

1. Your call won't be answered by an impersonal call centre. The team member who takes your call will have the first-hand experience of administering an estate and are bereavement trained, being highly sensitive to your needs at this difficult time. We guarantee your enquiry will be answered by an experienced and empathetic expert.

2. We don't have commission paid salespeople like a lot of companies do. If you need a free, no obligation home visit you will be seen by a director of the company; who will give you all the advice and information you need, along with a comprehensive and reliable quote.

3. We don't ask for any money up front when you instruct us unless there is an unusual situation so we know the quicker and more efficiently we complete the administration, the sooner we are paid. At the start of the process, we will highlight what the disbursements are likely to be based on the evidence we have. Our fees are clearly defined with no hidden extras so there are no surprises for you at the end of the process.

4. Our team are very experienced and we have a proven track record. We only employ fully qualified staff and we utilise state of the art case management software, making every probate process more efficient for us and every customer. We are the longest running, specialist Probate Administration Firm in the UK, and are endorsed by over 1000 independent funeral directors, as well as other legal and financial professionals.

5. We only deal with the best professional associates: Having an in-house independent financial service adds a new and positive dimension to our existing service. A solicitor can't give you financial advice and an accountant or financial advisor can't give you legal advice; we, however, can give you both. It has never been more important to protect what you create or inherit. Sound legal and financial advice is a must in today's increasingly complex legal world. We have professional links with property agents, accountants and many more, so we can offer you a true "one-stop shop" experience, saving you time, money and stress.

6. Although every case is different, we can give you a fixed quote when we meet with you and are anything between 15% to 48% less expensive than a typical solicitors fee. You can see our comparison prices here: http://www.probatebureau.com/why-use-us.

We don't charge an hourly rate or charge for each telephone phone call, email or letter so this means you can call whenever you have a question or problem without having to worry about escalating fees. We never compromise on the quality of service we provide and our aim is to save families time, money and stress at one of the most difficult times of their lives.

- We are qualified by examination to write Wills and associated documents

- We carry £2m of Professional Indemnity Insurance cover to protect our clients

- We carry £2m of Public Liability insurance cover to protect our clients

- We have undergone a Disclosure & Barring Service ('DBS'' formally 'CRB')

- We undertake regular professional refresher training ('CPD') to update our knowledge and service

- We are subject to the IPW's Code of Practice which has been approved by the Trading Standards Institute under its Consumer Codes Approval Scheme

- We also comply with The Solicitors Regulation Authority Code of Conduct

7. Finally, and most importantly we care. We are passionate and care about protecting and enhancing your inheritance. We won't treat you like another number, every one of our customers is unique and our team are trained to treat you exactly how we would like to be treated ourselves. If you are looking for professional help or just want to know how to administer an estate yourself, The Probate Bureau can help. We can tell you everything you need to know about administering a loved one's estate.

Give us a call on 0808 256 2366 to check what you should do, and more importantly, what you shouldn't do before you do anything else. The Probate Bureau - professional probate services in Hertford.

Share This Post

Recent posts

- Probate Delays and How to Speed Things Up in 2026 By Admin , 03/02/2026

- Inheritance Tax Planning: 2026 Allowances and Exemptions Guide By Admin , 03/02/2026

- Making a Will at Christmas: Why the Holidays Are the Right Time By Admin , 23/12/2025

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 2 posts

2023 Archive

- July 10 posts

2026 Archive

- February 13 posts

Blog Categories

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×