Wills and Probate News: June 2018

Wills and Probate News: June 2018

Save the Children launches a legacy campaign to inspire more gifts in Wills

Save the Children is asking people to consider their own legacy by showcasing a Liberian midwife, Alice Sumo, in a new legacy campaign, reports fundraising.co.uk.

Alice’s 30-year career delivering babies in Liberia has meant that over 800 “Alices” have been named after her. This, she says, is her legacy, as she asks what the viewers will be.

The campaign was created in-house with guidance from the agency Consider Creative. It follows Save the Children’s first ever legacies TV campaign, which launched in 2017. The new creative launches this month, with further digital and TV content rolling out in September.

The advert shows the work that Alice undertakes every day to make sure babies are delivered safely. Since Save the Children built the White Plains Clinic in 2014 funded by a Capital Appeal by UK supporters, it says, Alice is able to help save many more women and babies in her area. The hundreds of babies who are named after her range from two days to 30 years old. Save the Children is hoping viewers will be inspired by Alice’s story and consider leaving a gift in their will.

Gifts in wills contributed over £20million to Save the Children’s funding in 2017.

Jonathan Jacques, Head of Legacies at Save the Children, said:

“Save the Children has been saving children’s lives around the world since 1919 and every year the money our generous supporters leave in their wills helps us to make sure children are healthy and well-fed, protected from harm and receiving a good education.

“We wanted to tell a really unique and engaging story that our supporters could get behind. By inspiring our supporters with Alice’s legacy, we hope to emphasise what their legacy can be and to encourage them to download a free will-writing guide to find out more”

Watch the video

Will writing plea - as new data shows 38 unclaimed estates

NEW figures show there are 38 unclaimed estates left by Swindon residents who have died without writing their will, or without family members to claim their property, reports the swindonadvertiser.co.uk.

The official statistics, published by the government, include people who died as long ago as 1989. The majority are listed as singletons, widows and widowers.

Now a Swindon Will writer has issued a warning to people putting off making their will to do it without delay.

Reshma Field said: “Writing your will puts you in control, so you can decide what you want to do with your estate when you die. You’re in control, rather than the rules of intestacy.

“It’s probably one of the most important things you’ll ever do in your life.

“While a lot of people know it’s something they have to do, the other stuff of life gets in the way, like paying the mortgage.

“Writing a will gets pushed to the back of the list.

“Other things people say is that their estate isn’t complicated, so why do they need a will?

“But it makes it far easier for your family to deal with your wishes. Your will is your instructions about what you want to be done.”

Under intestacy rules, if someone dies without a will then their husband, wife or civil partner keeps their assets up to the value of £250,000. For those without a partner, but with surviving family members, the property will usually go to them.

However, if someone dies and leaves behind no living relatives and no will their estate will go to the Crown.

Writing a will could help charities. Brighter Futures, the Great Western Hospital charity trying to raise £2.9 million for new state-of-the-art radiotherapy machines, received £130,000 in legacy donations in 2017. It included a £73,000 donation to the children’s play department at GWH.

Chloe Thomas, a fundraising manager at Brighter Futures, said: “Leaving a gift in your will to Brighter Futures, no matter how big or small means we can continue to enhance patient care that’s not already covered by the NHS.

“People are able to pick a ward or service that’s important to them. It allows us to continue ongoing fundraising.”

In 2017, the latest year for which figures are available, £35,000 was donated to the Brighter Futures radiotherapy appeal in the form of legacies.

The appeal currently has £600,000 left to raise.

Learning to talk about death

Death is the one thing no one can escape, yet few people feel comfortable discussing it.

So a group of has decided to get together to give people of all ages a chance to learn how they can get their affairs in order should Death come knocking.

The session offered advice for financial planning as part of Dying Matters Awareness Week.

“I want people to be able to discuss dying, it is a way of nature that so many people fear and will refuse to talk about,” said Robert Young an estate planning consultant.

“If people take away the taboo of it, they will have a more relaxed approach which will help them when sorting out their affairs.

“Once they have sorted out their will and lasting power of attorney they will be able to stress less and enjoy the rest of their lives, with the knowledge that their family will be taken care of.”

More than 50 people went to the coffee afternoon and he was delighted with the turnout.

“It was fantastic and it benefits everyone, I hope they went away feeling more open to the subject and realised how vital it is to get everything sorted,” he said.

“It is going to happen to all of us one day, so why not plan for it and get on with enjoying your life, imagine having that weight and pressure lifted from your shoulders.”

Aimed at people from the age of 30 through to retirement, the event offered information about will writing, pensions and funeral services.

Dying Matters is a coalition of groups and organisations over England and Wales that was formed with the idea of helping people to talk more openly about death, bereavement and making life easier for families left behind.

It currently has more than 32,000 members.

Led by the National Council for Palliative Care, which was set up 25 years ago at the request of the government to advocate for end of life care, it works with communities to get people to have the uncomfortable conversations, get plans in place and provide practical support.

It says changes in society's attitude towards death have led to a lack of openness and affected the range of support and care services available to patients and their families, and even affected people's ability to die where and when they wish.

Every year in May it hosts a range of events from educational programmes to help open end of life discussions with children, death cafes, exhibitions and even a death fair.

Reasons to have a will

Brought to you by Telegraph Financial Solutions

More than half of British adults have yet to write a will, even though dying without one could mean their final wishes aren’t carried out.

A recent study found that 51% of adults have not prepared a will.

Dying intestate, or without a will, means that people you want to benefit from your estate - such as a partner you're not married to or in a civil partnership with – may get nothing.

If you don’t have any living relatives and want to leave your property or possessions to friends, but you haven’t written a will, the Crown may take your estate.

Benefits of writing a will

Writing a will can provide valuable peace of mind that your estate will go to exactly who you want when you die. It also means if you are a parent that you can state who you want to look after your children should you die when they are young.

Peter de Vena Franks, campaign director for Will Aid, said:

“Writing a will is an opportunity for a parent or parents to leave instructions about who they would like their child to be cared for by in the event of their death.

“If you die without appointing a guardian, and there is no other parent with parental responsibility, an application would need to be made to the court to decide with whom your child will live, in the event of a dispute about this. Preparing a correctly worded will with a solicitor is the best way to ensure your wishes are carried out.”

Under the Will Aid scheme that takes place throughout November, law firms pledge their time to write basic wills, with clients making a voluntary donation to Will Aid, which supports the work of the nine partner charities. These include Save the Children, the British Red Cross and Age UK.

How having a will can help with tax planning

If you don’t make your wishes clear in a will, there is also the risk that you could end up leaving loved ones with an unexpected tax bill.

Inheritance tax (IHT) is payable at a rate of 40% on the value of your estate above the current £325,000 threshold. Since April this year, IHT changes mean you can claim an additional allowance of £100,000 to offset the sale of a family home on death. This will eventually rise to £175,000 per person by April 2020. You can only use the allowance if you are passing your home to your children or grandchildren, not any other relatives.

According to figures from HMRC, IHT receipts have surged by 18.7% this tax year with £2.4bn taken from people’s estates between April and August alone.

Part of the problem is that many people aren’t aware that there are steps they can take, including writing a will and making use of annual allowances and reliefs, that can help them reduce IHT bills. Research by financial advisers Drewberry found that 87% of people in the UK who want to pass on assets to loved ones haven’t even considered IHT.

Tom Conner, director at Drewberry said:

“The point is that IHT is no longer just for the ‘Downton Abbey Set’. The 2016/17-tax year saw 45,000 UK households hit with IHT bills and this number is set to rise even with the introduction of a new residential nil-rate band.” IHT planning can be complex, so it’s important to seek professional advice if you’re unsure how to proceed. Bear in mind too that even if you have written a will, it may need updating, if for example, you’ve got divorced or have had children.

Writing a will: 13 common mistakes to avoid

Read more: https://www.which.co.uk/news/2018/03/writing-a-will-13-common-mistakes-to-avoid/ - Which?

By making a will, you control what happens to your worldly possessions when you die – but there are a number of simple mistakes that could stop your wishes being carried out. The laws around wills are complex, and the stakes are high – from accidentally disinheriting a loved one, to voiding the entire document. Whether you’ve written your will already or are thinking about doing it soon, Here are the common pitfalls that could cause trouble when you’re gone.

1. Not having two valid witnesses on a will

For a will to be valid, it must be signed in the presence of two independent witnesses over the age of 18. After you’ve signed the document, you must watch the witnesses sign it. If there is just one witness, the will won’t be valid. Your witnesses also need to be physically present when you sign, so they could invalidate your will by stepping out of the room at the wrong moment.

2. Storing photocopies of a will

When you die, your executors will need your original will to legally administer your estate – not just a photocopy. Without the original, it will be difficult for your executors to obtain a grant of probate to manage your affairs. So, make sure the people close to you know where to the original of your will is stored.

3. Asking a child or partner to be a witness on a will

Witnesses aren’t allowed to benefit from your will in any way – meaning if your child or partner signs the will, you could inadvertently disinherit them. When you choose your witnesses, make sure that they won’t stand to inherit anything from your will.

4. Making changes to your will

You can’t make amendments to your will after it has been signed and witnessed. So, putting a note and initialling it won’t count. Instead, you’ll have to make an official alteration called a codicil. This must be signed and witnessed in the same way as a will. There are no limits to the number of codicils you can add to a will. That said, if there are major changes, it may be worth making a brand new will to avoid any confusion.

5. Forgetting intangible assets in your will

Your house and car tend to be the most obvious things that you leave behind. But don’t forget your intangible assets, such as bank accounts, premium bonds or shares. You may also be able to pass on air miles or loyalty points if you’ve built up a large pool. It may be worth including electronic assets – digital photo albums or music collections, for example. You can also leave information about your social media accounts in your will so that relatives can manage your digital legacy.

6. Being too specific in your will

It’s important to be clear about your wishes. But if you pass on specific assets that are likely to change, your will may be outdated by the time you pass away. For example, you may wish to leave your Ford Fiesta to your eldest child, then later upgrade to an Audi. Your other children, or even the executor, may dispute your eldest’s right to inherit the car. To avoid this scenario, either keep your will up to date, or stick to more general descriptions of the asset, such as ‘the car in my name.’

7. Forgetting to name an executor in your will

When you die, you will need an executor to deal with the administration of your estate in accordance with your will. However, many people forget to name the executors of their will. When this happens, the probate court will appoint someone to act as executor, who might not have been your first choice. Keep in mind that you can appoint more than one executor, and these can be relatives, friends or even a solicitor.

8. Writing a will assuming you’ll die first

A will sets out what happens when you die, but you might not be the first to go. You should think through all possible scenarios and set out what you would like to see happen in each.

9. Getting married or having a child without a new will

When you get married, your existing will automatically become invalid. If you die without creating a new will, your spouse will automatically inherit half (or even all) of your estate under the intestacy rules – potentially disadvantaging your children. To divide up your estate in the way you think is best, you need to write a new will every time you marry. Similarly, if you don’t choose a guardian for your child in your will, the decision about it could go to family courts – so update your will when you become a parent.

10. Excluding your step-children from your will

When you make reference to ‘my children’ in your will, be aware that this won’t automatically cover step-children or foster children, even if you raised them and consider them to be your own. Legally adopted children will be considered the same as biological children, however. If you want to provide for your step-children or foster kids, you’ll need to be explicit about them benefiting from your will.

11. Assuming your partner gets half

Unmarried partners aren’t entitled to anything from your estate unless specifically stated in your will – no matter how long you’ve been together. Writing a will ensures your partner will get their fair share.

12. Disinheriting without providing a reason

If you’re planning to leave a dependent out of your will, you need to be explicit about why you’re doing so and where you’d like your money to go instead – or they could successfully contest your decision.

One case that hit the headlines last year shows just how tricky this area of the law can be. Heather Illot challenged her mother Melita Jackson’s decision to leave her entire £486,000 estate to three animal charities. After 10 years in the courts, Ms Illot received a £50,000 share after challenging the will under the Inheritance (Provision for Family and Dependants) Act and was awarded £50,000 on the basis she had been ‘unreasonably’ excluded.

13. Lacking full capacity when making your will

You need to be of sound mind when you make a legal will, so make sure you do it when you’re not drinking, on heavy medication or otherwise mentally compromised. If you’re under the influence of alcohol or drugs while making your will, its validity could be contested after you pass away. What happens if your will is invalid? If you die without a will, or your will is found to be invalid, you won’t have any control over how your estate split up. Your assets may end up being distributed according to the rules of intestacy – so if the estate is worth more than £250,000, half will go to your spouse and the other half split between your children.

Share This Post

Recent posts

- What Happens If You Die Without a Will in England and Wales By Admin , 04/03/2026

- Power of Attorney vs Deputyship: Which Do You Need? By Admin , 04/03/2026

- Probate Delays and How to Speed Things Up in 2026 By Admin , 03/02/2026

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 2 posts

2023 Archive

- July 10 posts

Blog Categories

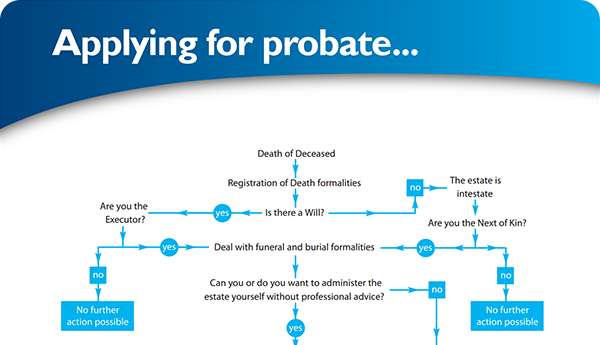

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×