Probate Services Chelmsford

Probate Services Chelmsford

Probate Solicitors Chelmsford Explained by The Probate Bureau.

What Is Probate?

Probate is the process of dealing with the estate of someone who has died, this generally involves clearing their debts and distributing their assets in accordance with their will. When you are granted probate, you have permission to carry out the wishes within someone’s will. If you become responsible for executing someone’s will, there will be specific rules that set out how you should notify the authorities and distribute the estate.

How Does Probate Work?

The probate process of settling someone’s will depends on whether you choose to do it yourself or appoint a professional to act on your behalf. Appointing a professional is a good idea, especially if you’re dealing with a complex estate. If you decide to administer the will on your own, you’ll need to fill out the relevant forms to obtain the right to become an executor. Then you’ll need to gather all of the deceased person’s assets and distribute them on to the beneficiaries. This process will involve notifying banks, building societies, relevant government departments (such as the council and HMRC) of the person’s death, setting up any accounts they hold, tallying up their assets and liabilities, paying off any inheritance tax that might be owed, and then finally distributing their assets.

What Happens If There Isn’t A Will?

If someone doesn’t have a will when they pass away, the probate process will still happen, but the deceased’s money, property and possessions will be shared out according to the law instead of their wishes and they will have died “intestate”. If they have any children which are minors, the probate court will have to designate a conservator for them, in addition to a guardian. Also, if there isn’t a will only direct family will inherit. Any unmarried partners or friends will not inherit.

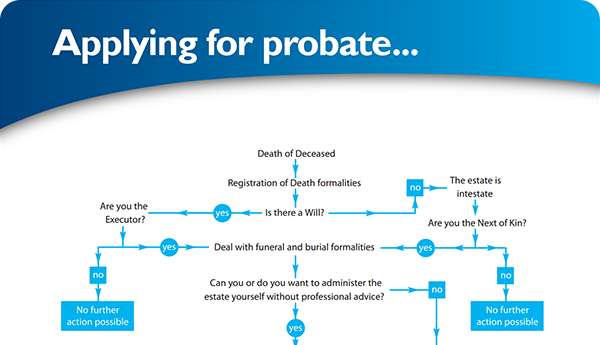

What Is The Probate Process?

The probate process usually consists of:

- Valuing the estate

- Collating the deceased bank accounts and insurance policies

- Completing the Probate Application Form (PA1)

- Even if the estate doesn’t own inheritance tax (IHT) an IHT205 Form needs to be completed for the HMRC

- Submitting the forms

- Attending a probate meeting to vow ‘on’ oath what you have presented is exact

- Paying the taxes due

How Is An Executor Chosen?

The person who administers probate is known as the ‘executor’ and is generally chosen in the deceased’s will. Mostly, the executor is a family member or friend of the deceased, but they can also choose a professional executor.

What Are Probate Fees?

Probate fees are the charges for the services of both the solicitor and the executor, which are taken from the deceased’s estate. In the event of the executor being a family member, who will inherit from the estate, then it’s common for them to waive their fees.

Inheritance Tax.

Inheritance tax is the tax on property and money acquired by inheritance. An estate will owe tax at 40% on anything over the £325,000 inheritance tax threshold when the owner dies, or 36% should a minimum of 10% be left to charity. The standard inheritance tax rate is 40%. It’s only charged for your estate that is over the threshold of £325,000. As an example, if your estate is worth £500,00 your tax-free threshold is £325,000. The inheritance tax is going to be costed at 40% of £175,000 (£500,000 minus £325,000).

About Probate Lawyers in Chelmsford.

The Probate Bureau was established in 1999 by David and Eve West after people were suffering from issues with a few of the traditional providers of probate estate administration services. We work together with our sister company TPB Financial Services, to offer custom legal and financial services, saving families money and administering estates in sometimes half the time and half the cost of most other providers.

The Probate Bureau Ethos.

Here at the Probate Bureau, our overall aim is to save families time, money and stress. We shoulder the whole burden of winding up an estate from paying the funeral director to getting final Inland Revenue Clearance. We provide the best service at a fair and reasonable fixed fee and we are able to administer most of our estates within 6 months by our highly efficient and qualified team led by our in-house lawyer.

Over the years we have found that people really do appreciate a free, non-obligatory meeting in their own home where all their concerns and questions can be answered fully. We don’t have any paid consultants, nor do we pay out or receive any commissions from anyone. We are the longest running specialist estate administration firm in the UK, recommended by over 1000 independent funeral directors, so we have earned a high degree of trust allowing us to secure professional discounts - ones which will allow more money to be retained within a family.

We deal with clients from Hertfordshire, Essex, London and beyond. One of our strengths is that we are not a firm of solicitors, therefore we don’t need to charge an hourly rate for each telephone call, email or letter. This means that our clients can call whenever they have a question or problem without having to worry about escalating fees.

So, if you feel you are in need of some specialist help to simply want to find out how you can administer an estate yourself, The Probate Bureau will be able to help. We will be happy to tell you everything you need to know about properly administering a loved one’s estate.

Feel free to call us on 0808 256 2366 to check what you should do, and most importantly, what you shouldn’t do before you do anything else. The Probate Bureau - Professional, reliable probate service in Hertfordshire.

Back To BlogShare This Post

Recent posts

- What Happens If You Die Without a Will in England and Wales By Admin , 04/03/2026

- Power of Attorney vs Deputyship: Which Do You Need? By Admin , 04/03/2026

- Probate Delays and How to Speed Things Up in 2026 By Admin , 03/02/2026

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 2 posts

2023 Archive

- July 10 posts

Blog Categories

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×