Wills and Probate News : December 2018

Wills and Probate News : December 2018

Wills and probate news compiled by the Probate Bureau.

Wills and probate experts in Hertfordshire and Essex, The Probate Bureau, have compiled the latest news, advice and guidance on Wills and Probate from around the world.

Grants Of Probate: A Place In The Sun, But The Assets Stay?

More than 100,000 Brits move permanently abroad each year, with many upping sticks in search of warmer climates and an escape from the hustle and bustle of life in our grey and crowded cities writes Lexology.com. Many expats sell up and cash in before making the move, often because this is necessary to finance their new lifestyle. However, many decide to retain some property, investments or accounts in England.

The problem is that many fail to consider what would happen to their English assets after their death, Even if they have made a valid will clearly stating how their estate is to pass, the process of collecting and distributing these assets is not as straightforward as they may think.

A Grant Of Probate is required in England and Wales before the assets of the deceased can be collected and distributed to the beneficiaries of a will. Usually, when an expat holds assets in their new country of residence and in their country of origin, it will be necessary for a Grant of Probate (or their foreign equivalent) to be obtained in both countries where assets are located. For example, an expat living in Spain will require a Grant of Probate to administer their English estate and a Spanish Deed of Inheritance to administer their Spanish estate. This two-pronged process can be lengthy and time-consuming.

The good news is that for expats living in most Commonwealth countries, the process is simplified because the English estate may be administered without the need for an extra grant. Under to Colonial Probates Act 1892, an application can be made to the Probate Registry for a foreign grant to be re-sealed. Happily, re-sealing is not an intricate legal term - it simply involves the placing of a new seal on an original foreign grant of probate. This gives the grant the same effect it would have had it been granted in England or Wales.

Countries that fall under this act include Antigua, large parts of Australia, Barbados, New Zealand, Jamaica, Cyprus and Hong Kong. Given that Australia and New Zealand are the most common destinations for Brits moving abroad, the potential benefit of the Act should not be understated.

Whilst re-sealing expedites the process of administering the estate, it is wise to instruct a professional as the procedure is not always simple, particularly when the estate is subject to inheritance tax in the UK.

Inheritance Tax Hits Record High of £5.2bn in 2018

Inheritance tax receipts hit a record high of £5.2bn last year, according to new statistics published by HM Revenue & Customs ahead of a government-ordered review of the inheritance tax system reports the financial times.

Inheritance tax payments rose 8 per cent on year in 2017/2018, to £5.2bn, according to HMRC data released on Tuesday, as factors including rising property prices required more people to pay the controversial tax.

The new figures also confirmed that a spike in deaths during the winter results in a 22 per cent jump in inheritance tax receipts between 2014/15 and 2015/16. There were an estimated 43,900 “excess deaths” in the winter of 2015, resulting in double the average annual increase in inheritance tax for the period, according to HMRC.

Inheritance tax receipts have risen, on average, 10 per cent a year since 2009/10, as property prices have soared above the rate of inflation, while the nil-rate band - the threshold above which individuals pay inheritance tax - has remained frozen at £325,000.

The total number of estates liable for inheritance tax - often dubbed Britain’s “most hated” tax - has also risen every year since 2009/10, with Londoners and those in the South East of England paying the most. In 2015/16, the average taxpayer in London has an average liability of £223,00 per estate.

However, the most recent data does not illustrate the full impact of a new “residential” nil-rate band introduced last year in addition to the £325,000 standard nil-rate band.

The new residence nil-rate band applies to death on or after 6 April 2017. It will allow individuals with direct descendants to pass on an additional £100,000 this year, with savings eventually rising to £175,000 over the next three years. By April 2020, couples will be able to pass on a family home worth £1m without incurring IHT liabilities.

The Office for Budget Responsibility has forecast that the new band could reduce inheritance tax receipts for the Treasury by around £200m in 2017/18, and by around £1.5bn in 2020/21.

But the residence band, as well as all other elements of the current IHT system, all face a potential overhaul in this year’s budget, after chancellor Philip Hammond announced a review of the “particularly complex” tax in February.

Danny Cox, a chartered financial planner at Hargreaves Lansdown said: “The workings may be under review but the Treasury continues to reap the dual benefits of rising property prices and frozen allowances with another year of record IHT receipts.

“Much of the current IHT workings are complex and distort people’s behaviour and financial decisions,” he added. “The system is crying out for simplification.”

Positive Signals For Farmers In First Inheritance Tax Review

Farms and estates can take some positive signals from the first part of the long-awaited inheritance tax (IHT) review, according to specialist agricultural accountants.

The Office of Tax Simplification (OTS) is undertaking a two-part review of inheritance tax at the request of the chancellor the exchequer.

Its recommendations are eagerly awaited, given the importance of agricultural property relief (APR) and business property relief (BPR) to the agricultural sector, with 100% tax relief on offer for qualifying businesses and assets.

The first report, published on Friday 30 November, largely deals with the complexity of administrative issues associated with IHT.

The key recommendation is that technology should be used to make dealing with tax on a day-to-day basis much easier.

Second Report

A second report will follow in Spring 2019, which may recommend more fundamental changes of IHT and the way reliefs and allowances are implemented.

However, advisers who work on behalf of rural businesses have highlighted that there are some positive pointers for farmers in the initial report.

Sean McCann, a chartered financial planner at NFU Mutual, said although it acknowledged that inheritance tax was complex, the reliefs used by farming families were singled out as being simple and straightforward.

“It was good to see a spotlight shone on the taxation of furnished holiday lettings, which are commonly used by farmers to diversify the farm business,” he added.

“In general, these lettings are treated as a trade for income tax and capital gains tax, but aren’t normally eligible for business property relief, meaning they are subject to inheritance tax.

“It’s an anomaly that continues to catch out farming families.”

Simplification?

David Chismon, a partner at Saffery Champness, said his reading of the report did not pick up on any appetite for drastic change.

“The report says the change should focus on the practical application of these reliefs and it is hoped that simplification will iron out confusion - for example, in relation to furnished holiday lets, certain joints ventures and limited-liability partnerships.”

“Hopefully any change will clarify that these businesses do qualify for relief rather than categorically excluding them.”

Sharon Omer-Kaye, head of RSM’s rural services sector group, agreed it was positive that so far the review stopped short of proposing any major changes.

“However, there is no doubt that the application of these reliefs is complex and often leads to uncertainty, so any simplification should be welcomed.”

Need advice? The Probate Bureau offer financial and inheritance tax advice, will writing and probate administration services throughout Hertfordshire and Essex. Call a member of our friendly and knowledgeable team today on (freephone) 0808 120 5420.

Back To BlogShare This Post

Recent posts

- Probate Delays and How to Speed Things Up in 2026 By Admin , 03/02/2026

- Inheritance Tax Planning: 2026 Allowances and Exemptions Guide By Admin , 03/02/2026

- Making a Will at Christmas: Why the Holidays Are the Right Time By Admin , 23/12/2025

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 2 posts

2023 Archive

- July 10 posts

2026 Archive

- February 13 posts

Blog Categories

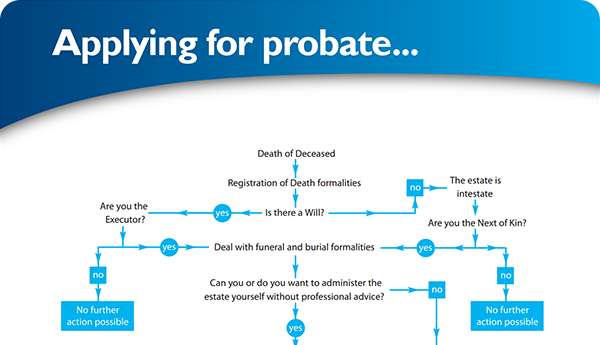

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×