Wills and Probate Services Colchester

Wills and Probate Services Colchester

The death of a loved one can be a very steep learning curve for everyone. Alongside the shock of bereavement, many can find themselves with a mountain of paperwork and affairs that need to be put in order. Pensions, tax rebates, property, bank accounts and other financial affairs all have to be settled and tied up after a loved one dies.

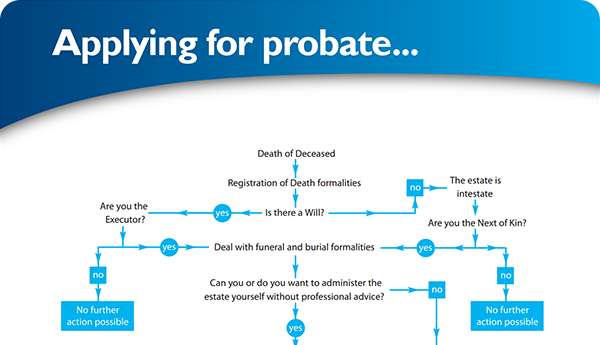

If you find yourself asking whether you really need probate, the answer is yes, you do. With most loved ones, you’ll need to obtain probate in order to deal with their estate. Probate is the process of settling someone’s estate or getting the permission to carry out the wishes within someone’s will. If you find yourself responsible for executing someone’s will, there are specific rules that detail how you should notify the authorities and distribute the estate properly. This method can be quite complex and confusing, so we suggest that you call us here at the probate bureau. We’ll be able to advise you over the phone or make an appointment in your own home for a trained adviser to visit.

So when do you need probate? Whenever the deceased has owned property, bank accounts, stocks or shares, had tax issues or when the estate is worth more than £5,000, it is a legal requirement to carry out probate. Here at the Probate Bureau, we have a network of solicitors who are capable of dealing with cases that require legal representation and can deal with specialised cases such as those involving trust funds or property abroad.

Who Do You Need Probate?

Probate is a legal requirement that shows the banks, financial institutions and other organisations that you have the legal right to be winding up another person’s affairs. All the dealings will be monitored by HM Courts and Tribunal services and are overseen by the local Probate Registry. Without this safeguard, it is possible that people could become victims of fraud - considering that there can be a lot of money at stake. After bereavement, it is advisable to get professional probate advice as soon as possible to minimise this risk.

Do You Need Probate If there Wasn't A Will?

If you need to sort out an estate when there isn’t a will, it will most probably take a bit longer than where there is a will. A person who dies without a will, will die ‘intestate’. As there is no will, the law decides who inherits the estate according to the ‘intestacy rules’.

Do I Need Probate To Claim Back The Funeral Expenses?

Not necessarily. However, it does depend on the size of the estate. The most common method of dealing with an estate is to open a designated bank account specifically to deal with all the payments and expenses.

How Much Is Inheritance Tax?

Inheritance tax is the tax on property and money acquired by inheritance. An estate will owe tax at 40% on anything over the £325,000 inheritance tax threshold when the owner dies, or 36% should a minimum of £105 be left to charity. The standard inheritance tax rate is 40%. It’s only charged for your estate that is over the threshold of £325,000. As an example, if your estate is worth £500,000 your tax-free threshold is £325,000. The inheritance tax is going to be costed at 40% of £175,000 (£500,000 minus £325,000).

The Probate Bureau Ethos

Here at the Probate Bureau, our main aim is to be able to save families time, money and stress in tough times. We are able to shoulder the whole burden of winding up an estate from paying the funeral director to getting the final inland revenue clearance. We provide the best service at a very fair and reasonable fixed fee and we are able to administer most of our estates within 6 months by our highly efficient and qualified team led by our in-house lawyer.

Over the years we have found that people really do appreciate a free non-obligatory meeting in their own home where all their concerns and questions can be answered fully. We don’t have any paid consultants, nor do we pay out or receive any commisions from anyone. We are proud to be the longest running specialist estate administration firm in the UK, recommended by over 1000 independent funeral directors, so we have earned a high degree of trust allowing us to secure professional discounts - one which allows families to retain more money.

Feel free to call us on 0808 256 2366 to check out what you should do, and most importantly shouldn’t do before you do anything else. The Probate Bureau - professional, reliable probate service in Colchester.

Back To BlogShare This Post

Recent posts

- What Happens If You Die Without a Will in England and Wales By Admin , 04/03/2026

- Power of Attorney vs Deputyship: Which Do You Need? By Admin , 04/03/2026

- Probate Delays and How to Speed Things Up in 2026 By Admin , 03/02/2026

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 2 posts

2023 Archive

- July 10 posts

Blog Categories

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×