When Should You Use A Probate Specialist?

When Should You Use A Probate Specialist?

If you find yourself responsible for handling a person’s probate, you could be forgiven for feeling completely overwhelmed and not certain on what the next best step is.

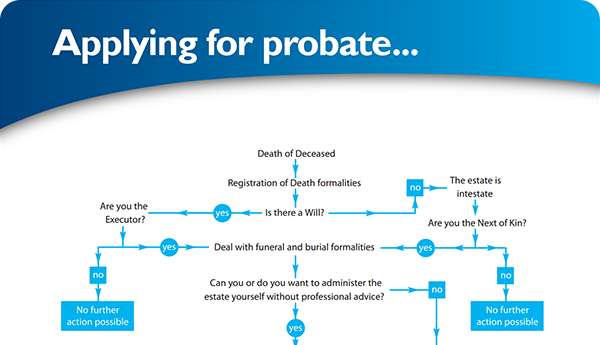

From planning a funeral to finding your own time to grieve, handling the death of a loved one can cause an array of unexpected emotions. With the journey ahead consisting of many routes to take, clarification of the right route to take when it comes to probate administration is most welcome.

If you’re not sure whether a probate company is right for you, we’ve listed three possible scenarios and the benefits that a probate professional can bring.

Inheritance Tax Threshold

Currently, the Inheritance Tax Threshold sits at £325,000 per person, meaning that any qualifying assets over that figure will be subject to 40 per cent tax. Estates over this threshold can also incur complex taxes that are recommended to be checked by a specialist, to ensure that the right amount of tax is paid.

Inheritance Tax can be mitigated before someone passes away with expert estate planning of their wealth and assets. Learn more about how our independent financial services can help, here.

No Will

When a person dies without leaving a Will, assets are distributed in accordance with the Rules of Intestacy. These rules dictate which family members are the rightful heirs. This, in itself, can be an extremely complicated matter with many decisions causing an unsettled result for many families.

A probate specialist can help mediate disputes in order to ensure all parties involved receive exactly what they are entitled to. Contentious probates can be by having a professional drafted Will. Learn more about the benefits of having a such a Will here.

Bank Charges

Each bank has different criteria when charging for their services towards a deceased estate. Having a bank as an executor, will result in higher fees. You can see our fees comparison table here.

An executor has a fiduciary responsibility to administer an estate in accordance with the law. The Probate Bureau is impartial and professional mediator, costing just a fraction of the fees usually charged by banks.

Speak to An Expert

The above examples tend to be the most common reasons why you should consider using a probate specialist. However, you are not limited to just these, as our expert team can help to give you advice on what to do next. As with bereavement, you should not have to handle it alone. Contact us today.

Share This Post

Recent posts

- What Happens If You Die Without a Will in England and Wales By Admin , 04/03/2026

- Power of Attorney vs Deputyship: Which Do You Need? By Admin , 04/03/2026

- Probate Delays and How to Speed Things Up in 2026 By Admin , 03/02/2026

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 2 posts

2023 Archive

- July 10 posts

Blog Categories

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×