Navigating the Probate Process with The Probate Bureau - Probate Service Basildon

Navigating the Probate Process with The Probate Bureau - Probate Service Basildon

When a loved one passes away, navigating your way through all the legal paperwork involved is tricky, especially when you're grieving.

Here at The Probate Bureau, we can offer an expert Probate Service throughout Basildon. We understand how hard it is to deal with both the passing of a loved one and the lengthy probate process, this is why we can shoulder the burden of winding up an estate in the most empathetic way. We'll provide you with the best service at a very fair and reasonable fixed fee price, as it is our goal to save families money. So, if you're in need of some help, be sure to give us a call on 0808 256 2366.

What are the Duties of an Executor?

Registering the Death

To be able to fully manage a person's estate, you will first need to register the death and obtain all the certificates as evidence.

Locating and Managing Assets

One of the first things you will then need to do as the executor of a will is to locate any assets the deceased may have had. This involves locating paperwork for any property owned, bank accounts, savings or investments.

It will be your job tokeep these assets safe until they can be properly distributed to creditors or beneficiaries named in the Will. That means securing their home and/or vehicles and protecting high-value assets.

This will also include cancelling credit cards and deciding which assets should be sold or kept, to wrap up their affairs.

Paying Inheritance Tax

If any Inheritance Tax payments are required. It will be your responsibility to put together the appropriate money to settle all the taxes due.

Paying off Debts

Once you have an accurate view of all the deceased's finances, you should ensure all debts are paid off. All creditors should be informed of the death and any outstanding debts cleared.

It's important to understand that creditors may request proof of death, which could mean sourcing multiple copies of the death certificate. They will also ask for a Grant of Probate.

To recieve the Grant of Probate, you will be required to complete a Probate Application form and a tax document to establish the IHT liability of the estate. If the estate is exempt of Inheritance Tax, you will still need to complete the forms.

Finding and Contacting Beneficiaries

You will be responsible for contacting those who have been named in the Will and informing them that they are due to inherit from the deceased.

Administering the Estate

Once you have paid any Inheritance Tax due and received the Grant of Probate, you can call in the assets and pay any debts. You will need to ensure you desl with any income tax or capital gains tax that is due and also deal with any bequests or pecuniary legacies that are detailed in the Will.

The final stage is to distribute the residuary estate to the beneficiaries. You will be accountable to the beneficiaries and it is therefore suggested that you keep clear records and estate accounts. You should also open a dedicated executor account for all the estate monies to come into.

Finding Out More about the Process and Getting Some Help

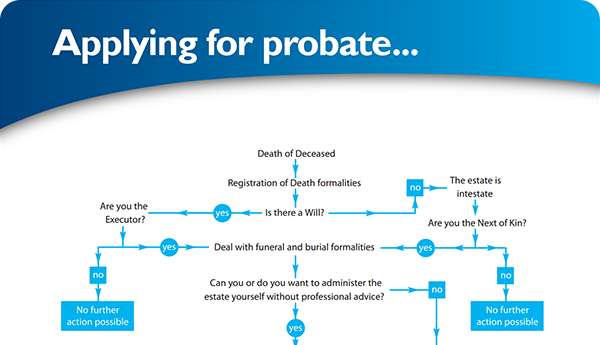

If you have been named an executor of a Will, or are the next of kin under the Rules of Intestacy, and would like more information on what you need to do, please be sure to view our 7-step guide to probate, or get in touch with one of our friendly experts who will be more than happy to help you through the process and give you the information you need to know.

Feel free to give us a call on 0808 256 2366. We'll make sure that we treat you with the professionalism and care that you need. We'll be more than happy to tell you exactly what you need to do and more importantly, what you should avoid doing before you do anything else.

Share This Post

Recent posts

- What Happens If You Die Without a Will in England and Wales By Admin , 04/03/2026

- Power of Attorney vs Deputyship: Which Do You Need? By Admin , 04/03/2026

- Probate Delays and How to Speed Things Up in 2026 By Admin , 03/02/2026

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 2 posts

2023 Archive

- July 10 posts

Blog Categories

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×