When I Die, Does My Debt Die With Me?

When I Die, Does My Debt Die With Me?

It can be worrying when a loved one dies and you know they had debt. The fear is that you will become liable for the outstanding payments.

Take a deep breath and relax. You cannot inherit someone’s debt. That is the simple answer. But, of course, where finances are concerned, it is never black and white.

In a nutshell, any outstanding financial obligations will be paid from the deceased’s estate. This could mean that if they have made a significant bequest to you in their Will, such as a property, you may not receive it. It is possible that it will need to be sold off to clear the debts.

Talk To A Professional

If you have been made an executor of the Will, it will be up to you to arrange with creditors to make the appropriate payments. But it would be our advice to speak to us about administering the estate.

Either way, you need to draw up a plan of action. Find out exactly what debts have been left and make a list. If you are unsure, a notice can be printed in the local press calling for people to come forward if they are owed money.

Bear in mind that there are two kinds of debt – individual and joint. An individual debt is, as you’d expect, a liability that is solely in the deceased’s name, for instance a credit or store card. A shared debt on the other hand is one where two or more people have taken on the loan or mortgage together. For shared debt, it is usual for the outstanding payments to be passed to the other signatories.

Pay In Order Of Priority

Have a look to see if there are any insurance policies that can help cover the cost of the outstanding liabilities.

Once you have your list of creditors, they will need to be paid in order of priority until the pot is empty. At the top of the list will be the secured debts, including the mortgage. Priority debts will come second; this category includes Income Tax and Council Tax. Unsecured debts, like credit cards, will bring up the rear if there is anything left. The remaining liabilities will be written off.

It can be extremely challenging and time consuming, ensuring that everything has been done by the book. Talking to us can help share the load. Give us a call to discuss today.

Back To BlogShare This Post

Recent posts

- What Happens If You Die Without a Will in England and Wales By Admin , 04/03/2026

- Power of Attorney vs Deputyship: Which Do You Need? By Admin , 04/03/2026

- Probate Delays and How to Speed Things Up in 2026 By Admin , 03/02/2026

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 2 posts

2023 Archive

- July 10 posts

Blog Categories

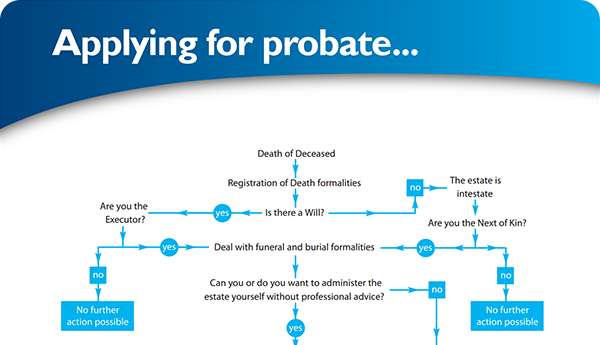

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×