Probate Case Study

Mrs Jones had concerns about both inheritance tax and the possibility of care fees in the future. With some creative trust work we were able to ensure financial security for her and her three children from a previous marriage.

At the meeting, we established that Mrs Jones didn't actually need the money she was due to inherit as she held sufficient funds in her own name.

Mrs Jones did however have concerns about both Inheritance Tax and the possibility of care fees in the future. We recommended that she should draw up a Deed of Variation leaving the cash in a Discretionary Trust for the benefit of her and her three children from a previous marriage.

We suggested that the property, worth £215,000, should also be placed in Trust protecting it in the event that she had to go into long-term care in the future. As long as the total value of an estate was under £325,000 (the current Inheritance Tax threshold) it was possible to protect the whole estate in trust.

After discussing it with her children, Mrs Jones decided to draft the Deed of Variation and the entire estate was transferred into trust. We assured Mrs Jones that, should she need access to the funds in the future, it would not be a problem. She could either simply withdraw the funds from the Trust and use them for whatever she needed, or alternatively, a Loan Note could be prepared to lend her money from the Trust whilst keeping it protected under the ‘Trust-wrapper'. Not only would the assets held in trust benefit from protection against care fees but probate should not be needed on her death and her children would immediately assume control of the Trust, saving them both time and considerable expense.

This case clearly demonstrates the many benefits of using a professional organisation like The Probate Bureau Ltd working in conjunction with The Probate Bureau Wealth Managemant

For free advice or help in planning ahead, call us now.

Request callback

We recieved your callback request. Will be contact you soon

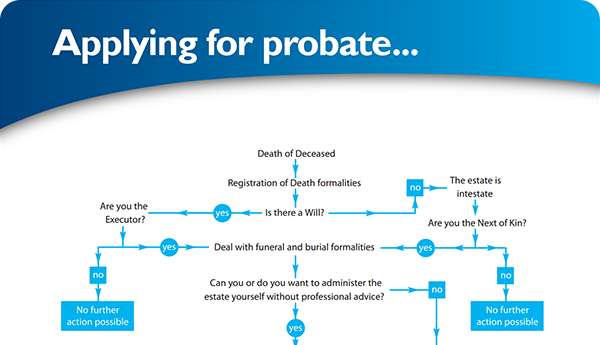

×Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×