Glossary of terms - Probate

To help lessen the burden of searching for the legal terms used when dealing with Probate. We have listed the most common Probate terms and provided a simply explanation for each.

Affidavit

A written statement which someone makes that may be used as evidence in a Court of Law

Beneficiary

A beneficiary is any person who is due to inherit from the estate. Their inheritance may be monetary or consist of a specific item which has been bequeathed to them. Beneficiaries will either inherit as a result of being named in the deceased’s Will, by default in accordance with the Rules of Intestacy or through being named in a Deed of Variation. An executor/executrix may be a beneficiary but a witness may not.

Bequest

A bequest is the gift of a specific item. For example, if the deceased writes in their Will that they leave their wedding ring to their granddaughter, this is a bequest.

Codicil

A Codicil is an appendix to an existing Will. If a Will has already been made and there is just a minor alteration needed, for example increasing the amount of a pecuniary legacy, then instead of completely re-writing the Will it is suitable to draft and attach a codicil making the change.

Estate

This is the general term used to refer to everything a person owned upon their death, which then forms the inheritance due to their beneficiaries. It includes property, business interests, funds held in accounts, investments, life policies and pensions.

Executor/Executrix

The Executor (or Executrix if referring to a female) is the person appointed in the Will to administer the estate. They are legally responsible for applying for probate (which will be issued in their name) and dealing with the estate administration and distribution. They can be a beneficiary.

Funeral Arrangements

When a death has occurred, it is necessary to go to a Funeral Director to make arrangements regarding the organisation of the funeral. This includes choosing a coffin, what type of service is to be carried out, whether the body is to be cremated or buried, arranging flowers and many other details. Funeral Directors may also arrange repatriation if the deceased died abroad. The person responsible for dealing with this is usually the next of kin or executor named in the Will.

Grant of Probate/Representation

A Grant of Representation is a legal document issued by the Court. It allows the person named on it to legally handle the deceased persons' assets and estate. There are three types of Grant of Representation:

- Grant of Probate: granted to the executors named in the Will

- Letters of Administration (with the Will annexed): granted to someone other than an executor when the deceased left a valid Will

- Letters of Administration: granted when the deceased did not leave a Will

Inheritance Tax

Inheritance Tax is a levy charged by the government on estates worth over the Inheritance Tax threshold, often referred to as the Nil Rate Band ('NRB'). The threshold is currently £325,000 but may change on a yearly basis, in accordance with the government’s annual budget. All tax due must be paid from the deceased’s estate before funds are distributed. A Residential Nil Rate Band ('RNRB') is soon to be phased in whereby a married couple's estate may benefit from a £1,000,000 threshold.

Intestacy

This term is used to describe an estate where the deceased has died without leaving a Will. When someone dies intestate, the estate distribution is dictated by the Rules of Intestacy.

Last Will and Testament

Often simply referred to as a ‘Will’, this is a document written to stipulate a person’s wishes regarding how they want their estate to be distributed upon their death. They may also give instructions regarding funeral arrangements.

Letters of Administration

This is the document issued by the Probate Registry in an estate where there is no Will. It is the equivalent of a Grant of Probate (where there is a Will) or a Grant of Representation. It allows the named Next of Kin to administer the estate.

Pecuniary Legacy

A Pecuniary Legacy is the gift of money in a Will. For example, the deceased’s children may be left £5,000 each, this is a Pecuniary Legacy.

Personal Representative

The Personal Representative is the person appointed to deal with the estate administration. A Personal Representative performs the same role as an executor would otherwise do and is named on the Grant of Representation. They are repsonsible for applying for probate, administering the estate and distributing funds to the beneficiaries.

Probate

Probate is the legal term for processing and administering a deceased person's estate. In fact probate comes from the latin verb "probare" (to prove) as it refers to the proving of a Will. It is also commonly described as administering an estate.

Rules of Intestacy

Government legislation dictates in England and Wales who will inherit if no Will has been left. These guidelines are referred to as the Rules of Intestacy or Intestacy Rules. A detailed explanation of the Rules of Intestacy is available on our blog

Testator/Testatrix

The Testator (or testatrix when referring to a woman) is the person who makes a Will.

Trust

A trust is a legal arrangement where a person or organisation controls property and/or funds on behalf of another party.

Witness

A witness is someone who observes the signing of a document and then signs to attest that they have witnessed its execution. They may be called upon to swear an affidavit in the future if there is a problem with regard to the document. They can not be a beneficiary.

Request callback

We recieved your callback request. Will be contact you soon

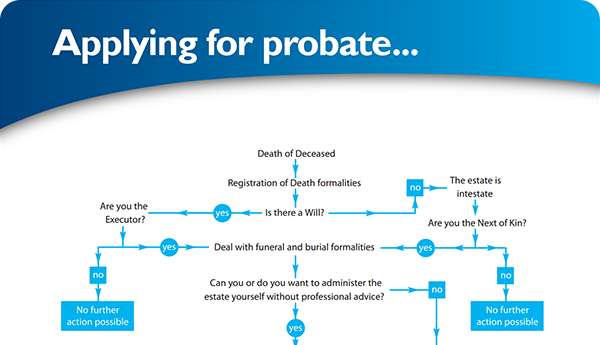

×Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×