Fixed Fee Probate in Hertfordshire

Winding up an estate can be an onerous task. We provide comprehensive explanations on the whole process; the legalities, forms, tax implications and much more. We know what you are facing and want to help. Here are some of the main issues to consider.

Contact The Probate Bureau today to discuss your circumstances.

How Much Does Probate Administration in Hertfordshire Cost?

It is vitally important to understand that there are several stages involved in the administration of an estate. Quotations can be very misleading because it depends which stages are being quoted for. It is not unusual to pay £2,000 plus VAT for a solicitor to just get a Grant of Representation for you and then charge you hundreds of pounds per hour to complete the full administration of the estate. We can deal with one or all of the stages with clearly defined fixed fees.

Our minimum fee for obtaining a Grant of Representation on your behalf is £950.00 plus VAT. Click here to see if you are eligible for this service.

If, however, you want us to administer the whole estate from start to finish, from obtaining a Grant of Representation right through to final distribution and Inland Revenue clearance, give us a call on 0800 028 2837 or complete our online enquiry form by clicking here.

How Long Does The Process Take?

The Probate Bureau prides itself on how quickly it administers estates. In our experience, a modest estate with no property to sell, can be fully completed within 3-6 months. Estates with property or inheritance tax issues or disputes may take longer. You may have heard of the expression the 'executor year'. It is often used to indicate that a year is considered to be a reasonable time in which to administer an estate. We consider that to be excessive in most cases. When The Probate Bureau was set up it set a standard - to be be half the price and twice as quick as the 'old school' practioners. We continue to live up to that standard with no loss of quality.

Please beware, there are many large probate practitioners out there taking well in excess of a year to administer modest estates charging more than we do! You may wish to look at our blog page for some review site links.

The 7 Step Checklist

Even a simple estate can take many hours to complete. There are many legal and financial disciplines involved in any administration. If you instruct us to handle everything you will have peace of mind knowing that all the 't's are crossed and all the 'i's are dotted at a set fee. Click here to view a comprehensive list of what's covered in our fee.

If you are looking to handle probate yourself, before you do anything else, click here to download our 7 Step Checklist. It will help you through the process and highlight some warnings on the way.

House Clearance and De-cluttering

The Probate Bureau is able to help in many cases where people need to move house and dispose of chattels. When a person is downsizing or moving into residential care, the family can find it a very onerous task, especially when family members live far away. The Probate Bureau can offer a comprehensive house clearance, property sale and conveyance service to the individual moving and his or her family. Please contact us for further details.

Sale of Cars and other such Assets

Whether you are an Executor or the next of kin seeking information and support regarding an estate, do not hesitate to call our qualified team. We have many professional links to assist with a multitude of related services from the valuation and sale of assets to home staging and tax saving. Most people are unaware of how much is involved with winding up an estate.

More Complex Probate Cases

If an estate is over £325,000, if there are foreign assets, a missing Will or missing assets, missing beneficiaries or disputes of any kind, the administration of an estate is far more complicated than you think. Because we are probate professionals, we have naturally evolved over the years to incorporate more specialised areas of expertise; all of which is focussed on helping you with the more complex issues involved with winding up an estate.

TRY THIS HANDY GUIDE TO SEE WHO INHERITS WHEN THERE'S NO WILL.

Let us guide you through the most recent (and often misunderstood) Rules of Intestacy by answering the questions below. If you get stuck at any point, or don't know how to answer, just give us a call and we can tell you definitively who is to inherit in any given situation.Stuck or confused? Get in touch at 0800 028 2837, or use the callback form below and we will contact you.

Request callback

We recieved your callback request. Will be contact you soon

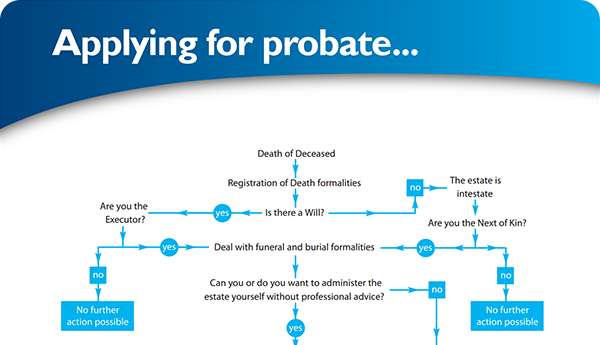

×Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×